As the year draws to a close, business owners and freelancers find themselves amidst the annual ritual of preparing 1099s, a crucial task for tax season. It’s a task that can completely take over the month of January, so it pays to do a bit of preparation.

While there are a lot of great tools out there to streamline the preparation of 1099s themselves, Track1099 and QuickBooks itself come to mind, the greater annoyance tends to be the checking and double-checking of data. Here’s where Amalgam can help – we’ve got a template for that!

Who Gets a 1099?

You probably know this already, but the IRS defines a few rules which determine which vendors should get a 1099. Here’s a non-exhaustive list of the key rules.

- Payment Threshold: If you make payments to a vendor or contractor amounting to $600 or more during the tax year, you are generally required to issue a 1099.

- Payment Type: Payments made with a credit card do not count towards 1099 thresholds.

- Business Relationship: 1099s are typically issued to individuals, sole proprietors, partnerships, and LLCs that are treated as sole proprietors for tax purposes. Corporations are usually exempt, except for payments made to attorneys and certain healthcare payments.

- Exclusions: Payments for merchandise, freight, storage, and similar items are generally not required to be reported on a 1099. Also, payments made to tax-exempt organizations and governmental entities are usually exempt.

- Payments to Attorneys: Payments of $600 or more to attorneys must be reported, regardless of the attorney’s business structure.

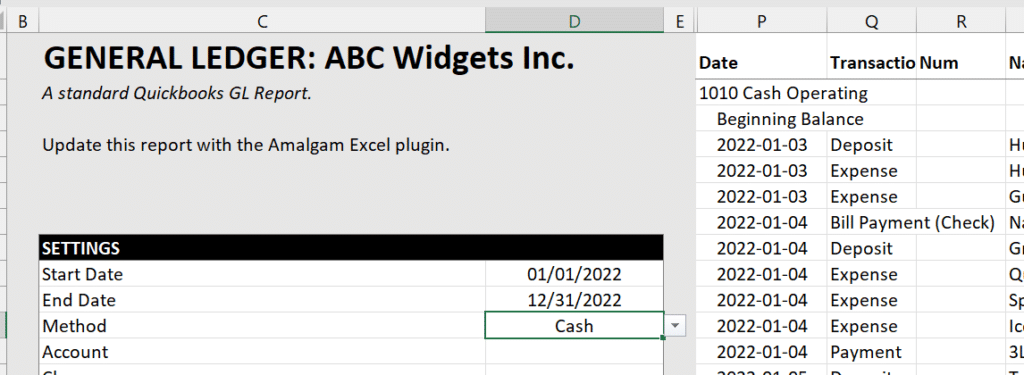

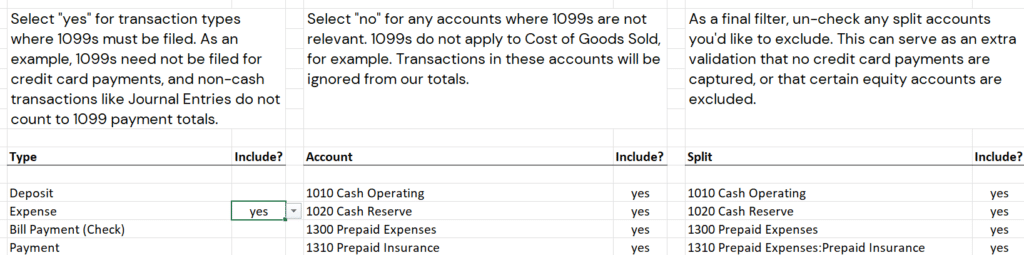

These may seem complicated, but ultimately these are just filters. Once your books are closed for the year, you can simply take your general ledger and filter it.

Once you have the ledger, you can simply go through and select which payments to include. Our template includes filters for transaction type (exclude credit cards, non-cash, etc.), account (exclude COGS or other excluded categories), and split account.

Once filtered, you’ll have a list of each Vendor in your account, listed in order of total payments made. All the Vendors with >$600 in payments make the cut!

Updating Information

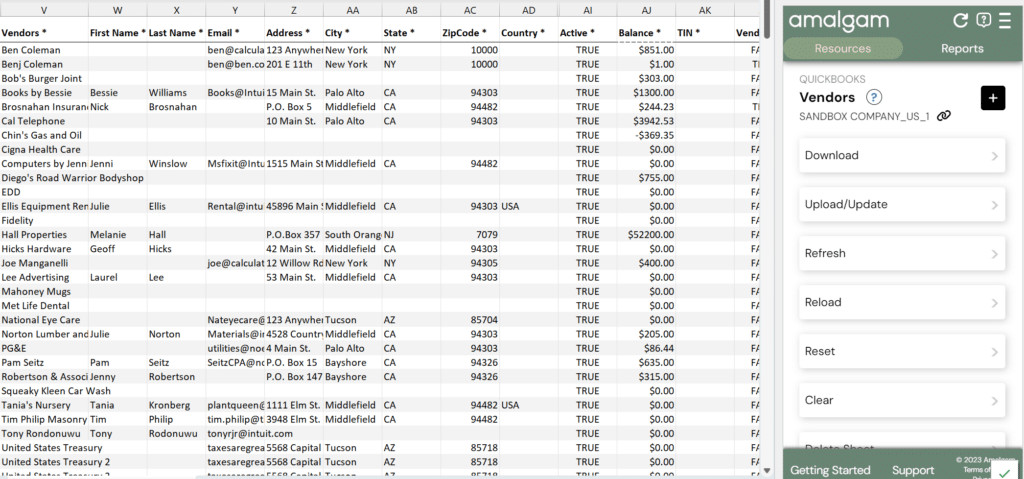

We can’t assist you in the tiresome process of requesting W9s from each Vendor you’ve done business with. But we can help you get that data into QuickBooks or whichever system you’ve elected to use to prepare your 1099s.

Amalgam Vendor resources let you download a full list of all Vendors in your account, and update those Vendors as needed. Use it to upload SSNs or EINs to each of your customers, input updated addresses, or flag which vendors are eligible for 1099s.

We can’t remove the headache of requesting data from other humans (though we do have thoughts on how to facilitate this process). But once you have the data, sorting through it doesn’t need to be difficult. If you’d like to give our template a shot, feel free to reach out to [email protected].