We spend a lot of time thinking about the best way of getting information from one place to another. Usually, for us, this means transfers of data from one online system to another. But ones and zeros aren’t everything!

Finance and bookkeeping are relationship businesses, and often your most important data sources are your clients themselves. They’re also often the least efficient, and the most likely to cause misunderstandings.

Today’s topic is one we’ve been discussing with our users quite a lot this month – training your client to do your job for you, and how that can be a win for both parties. Below you’ll find a video of us putting it all together at the end.

Our Example

The task we’re going to use as an example is a common one: classifying expenses from a credit card statement. While no example we use is going to be perfectly applicable to everyone, this situation contains a mix of email communication, automation, and file sharing that is representative of many regular processes in the broader financial world.

This process often looks something like this:

- The bookkeeper grabs a credit card statement in a CSV file and emails it to the client

- The client, in their own time, goes through that list and adds notes to each line

- Using these notes, the bookkeeper then works through each of these expenses, adding them to the accounting system, categorizing them to the correct expense account (or capitalizing if appropriate). This may involve some considerable manual work, depending on how nicely the card system plays with the accounting system

- The bookkeeper reaches back out to the client to confirm or clarify any remaining questions

Now, this isn’t a total nightmare, but even if we completely automate step 3, we still have a situation where the bookkeeper is acting as a translator between the client and the financial systems. We’re here to say that’s not actually necessary!

Step 1: Simplify the Jargon

For some clients this might not be necessary, but it always helps to remember that not everyone is a finance expert. That’s okay, and you don’t need to teach an accounting course here.

However, making sure you and your clients are clear on what the goals of each process are can be a huge aid to misunderstandings. If your clients know exactly what information you need out of them, that not only trains them to provide the right responses, it actually saves them time racking their brain for unnecessary details.

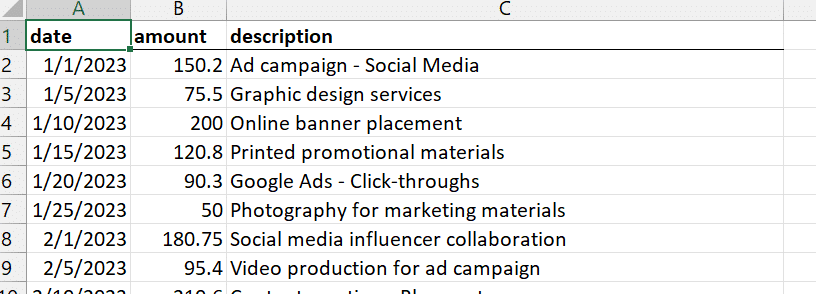

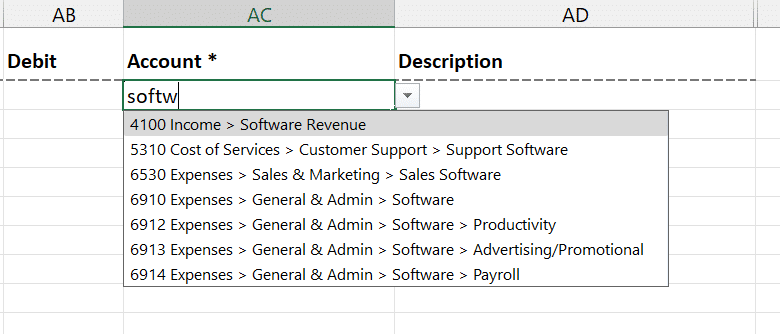

Step 2: User-Friendly Systems

How do you share data with your clients today? Spending five minutes preparing that information could save you hours down the line.

This could be as straightforward as providing them with a spreadsheet template that makes the information you need from them extra clear. The goal is to eliminate unnecessary complications and streamline the process.

When sharing data, keep in mind you’re basically acting as an app developer here. The file you share is a mini-application, and you need to make it user-friendly.

It’s counter-intuitive, but the most user-friendly systems are actually the ones that restrict the user’s options as much as possible. The more you can give your client only the options you actually want to see, the easier it is for them. And as you’ll see later, it makes things easier for you.

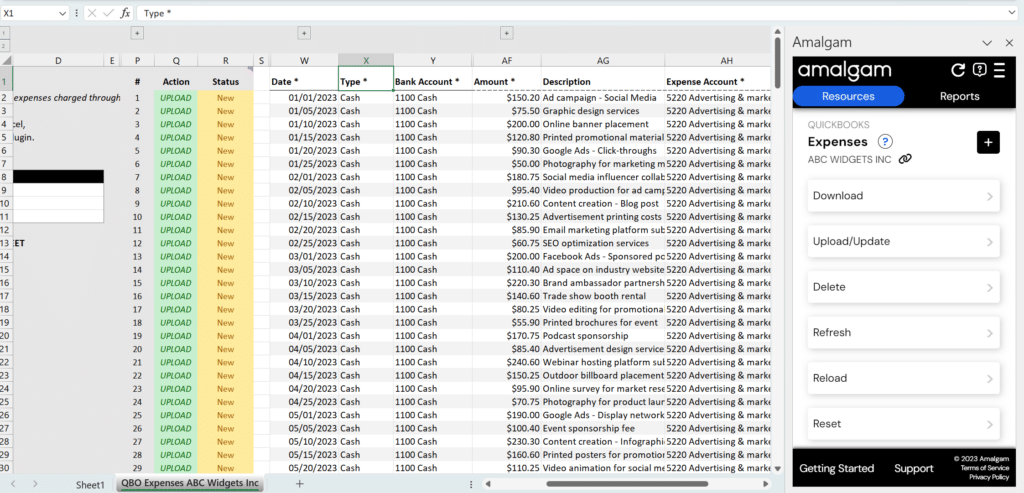

Step 3: Automate Data Flows

At this point, because of the preparation you’ve done, you know EXACTLY what information your client has sent back to you. That’s great, because that saves you all the work you’d ordinarily be doing translating client responses.

In fact, if you set everything up right, you can feed your clients response right into an Amalgam template which can upload fully-prepared data directly into your accounting system.

Using the app developer metaphor from before, you’ve now created an application that not only saves your “user” some time, but it guarantees that the user’s feedback turns into results as efficiently as possible.

Putting it All Together

This sort of preparation doesn’t need to be difficult. Here’s a video of it all coming together in only a few minutes.

Destigmatizing Doing Less

Saving time doesn’t mean doing less. As you’ve seen here, we’ve saved a huge amount of time without actually removing any of the useful work that clients value.

For bookkeepers, the advantages of client involvement extend far beyond the joy of a lighter workload. Time saved from not manually classifying every expense allows bookkeepers to focus on higher-value tasks, such as analyzing financial trends, providing strategic insights, and exploring growth opportunities.

For clients, even though they may be doing more of our work “for us,” the actual time commitment is most likely exactly the same, if not actually reduced. Furthermore, clients receive superior service and a drastically reduced close timeline.

Hopefully this example triggers some ideas. Automation and systems design work equally well for data stored in your clients’ brains!